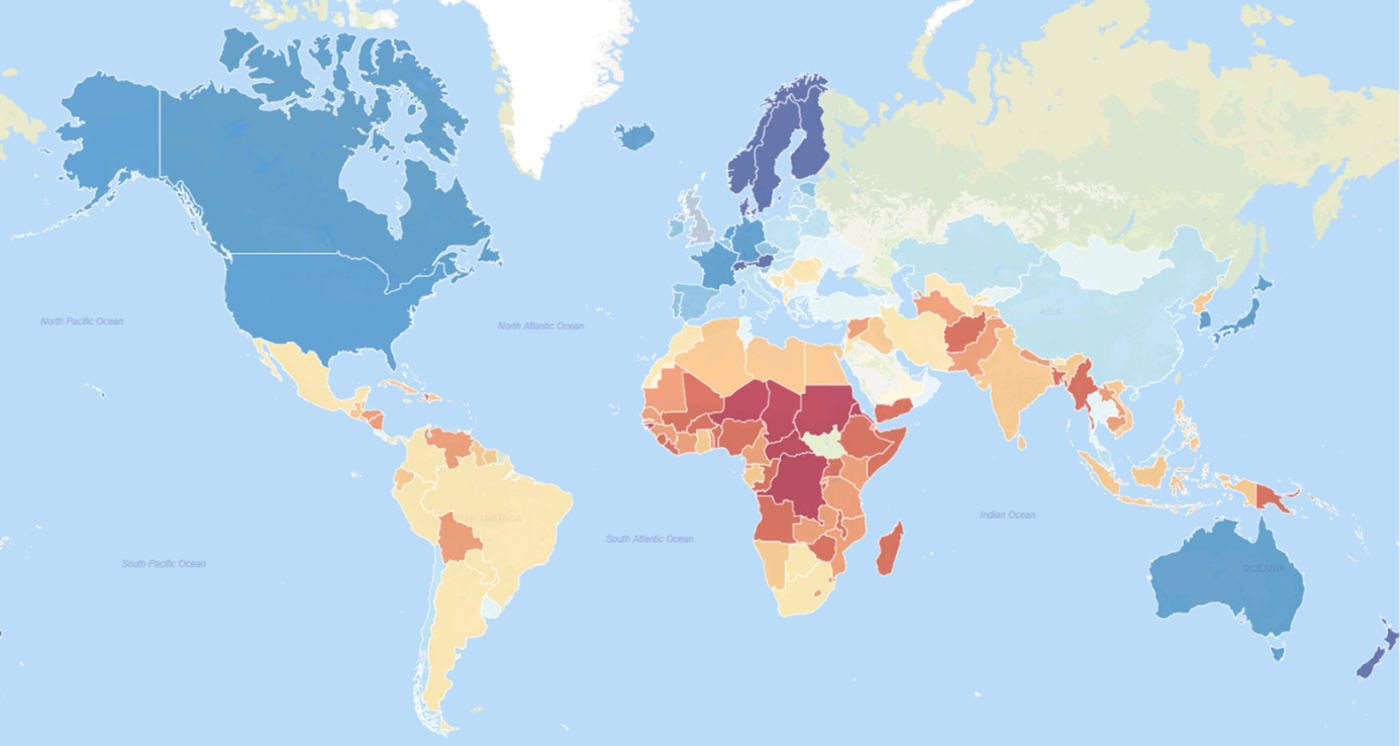

new market tax credit map 2020

95091 the department shall direct the Department of Revenue at any time before Dec. Projects closed on or after Nov.

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

31 2022 to recapture all or a portion of a tax credit authorized pursuant to the New Markets Development Program Act if one or more of the following occur.

. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year CY 2015-2020 allocation agreements announcing a change to extend the 36-month lookback period to Dec. Investments made through the NMTC Program are used to finance businesses breathing new life into neglected. When a user clicks on the map the info bubble displays values based on the 2011-2015 eligibility data.

The NMTC which faced expiration on December 31 after 20 years of success stories and strong bipartisan support is one of only two tax extenders to receive a five-year extension. 1 2018 must use 2011-2015 ACS low-income community eligibility data applied to the 2010 census tracts for. This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys.

The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. SCCLF will receive a 15MM NMTC allocation in 2020 and is the only South Carolina-based. The New Markets Tax Credit is taken over a 7-year period.

By providing 5 billion annually for 2021-2025 the Consolidated Appropriations Act of 2020 exceeds the 175 billion authorization included in the PATH Act of 2015. WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition today released its 2020 New. The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified.

Thursday January 7 2021. The credit rate is. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202.

The lookback period previously included transactions closed by May 31. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. Lake Forest CA July 23 2020 Clearinghouse Community Development Financial Institution Clearinghouse CDFI announced today that it has been awarded a 65 million New Markets Tax Credit NMTC allocation from the United States Department of TreasuryClearinghouse CDFI will use the tax credits to finance the development of community.

11 rows New Markets Tax Credit Program allocatees can make investments in all 50 states the District of Columbia Puerto Rico and certain US. 31 2017 the CDFI Fund released updated 2011-2015 American Community Survey ACS low-income community LIC data for the New Markets Tax Credit NMTC program. The New Markets Tax Credit NMTC program was extended through 2025 with a 5 billion annual appropriation as part of the Consolidated Appropriations Act 2021 signed.

Total credit equals 39 of the original amount invested in the CDE. Lac Du Flambeau WI. Awards will Spur Economic and Community Development Nationwide WASHINGTON The US.

The map displays allocatees that have. Wednesday May 4 2022. 31 2017 with a one-year transition period in which applicants can alternatively choose to use 2006-2010 data.

95091 the department shall direct the Department of Revenue at any time before Dec. The New Markets Tax Credit Program was designed to increase the flow of private sector capital to businesses nonprofits community facilities and other important projects into communities suffering from a lack of investment. Both sets of data2006-2010 data and 2011-2015 American Community Survey ACS low-income community LICwill be available in the NMTC Mapping Tool.

The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified Community Development Entities CDEs. From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars. The NMTC has supported more than 5300 projects in all 50 states the District of.

To change the time frame to 2006-2010 click. The map above and the search function below will display results by service area for allocatees that have received awards from 2012 to the present. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

Financing for the construction of a new Albertsons Market at 808 N. A total of 100 Community Development Entities CDEs were awarded tax credit allocations made through the calendar year CY 2020 round of the New Markets Tax Credit Program NMTC Program. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year CY 2015-2020 allocation agreements announcing a change to extend the 36-month lookback period to Dec.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393. New Markets Tax Credit Benefits. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225.

The new data can be used beginning Oct. Your project may be eligible for the Program based on its location in a qualified census tract. As of the end of FY 2020 the NMTC Program has.

Address Social Media. The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private investors. The 2011-2015 data is displayed by default.

NMTC Celebrates 20 Years Nearly 6400 Projects Financed and Over One Million Jobs. New Markets Tax Credit Program NMTC Program helps economically distressed communities attract private capital by providing investors with a Federal tax credit. The federal government recaptures any portion of the federal NMTC.

Generated 8 of private investment for every 1 of federal funding. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225. These investments will create jobs and spur economic growth in urban and rural communities across the country Secretary of the US.

The New Markets Tax Credit NMTC was established in 2000. 9162020 102847 AM. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005.

Over the last 15 years the NMTC has proven to be an effective targeted and cost-efficient financing tool valued by businesses communities and investors. And 6 of the original investment amount in each of the final four years. 5 of the original investment amount in each of the first three years.

New Markets Tax Credits. Either census database may be used to evaluate eligibility through a transition period ending October 31 2018. Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide.

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

New Markets Tax Credit Investments In Our Nation S Communities

Global Carbon Account In 2020 I4ce

New Markets Tax Credit Investments In Our Nation S Communities

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Welcome To The Cdfi Fund Cims Mapping Tool Community Development Financial Institutions Fund

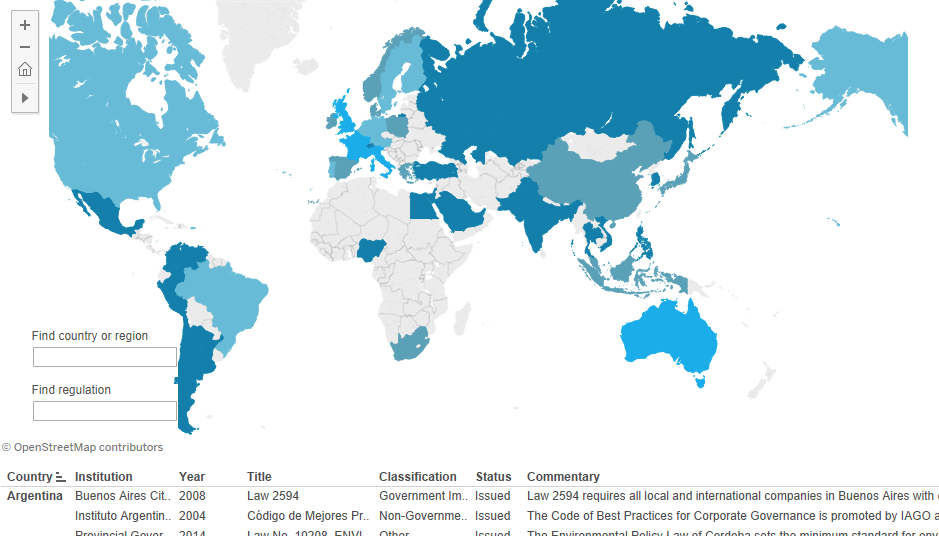

Responsible Investment Regulation Map Thought Leadership Pri

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

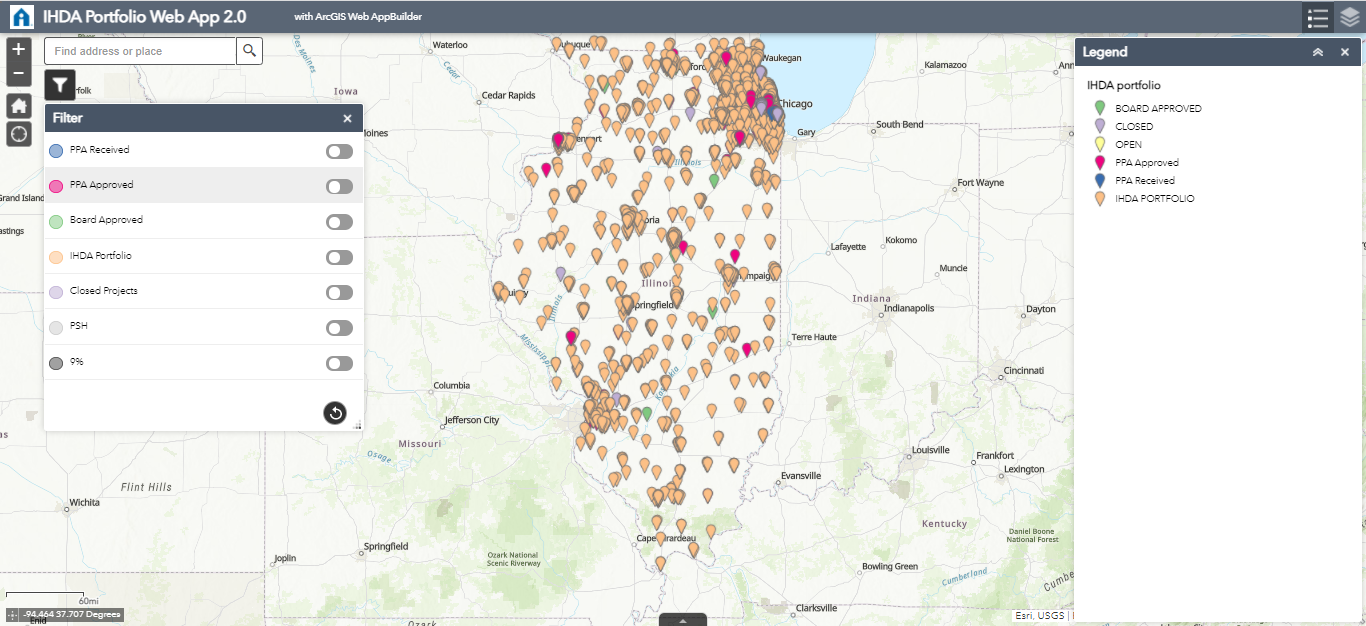

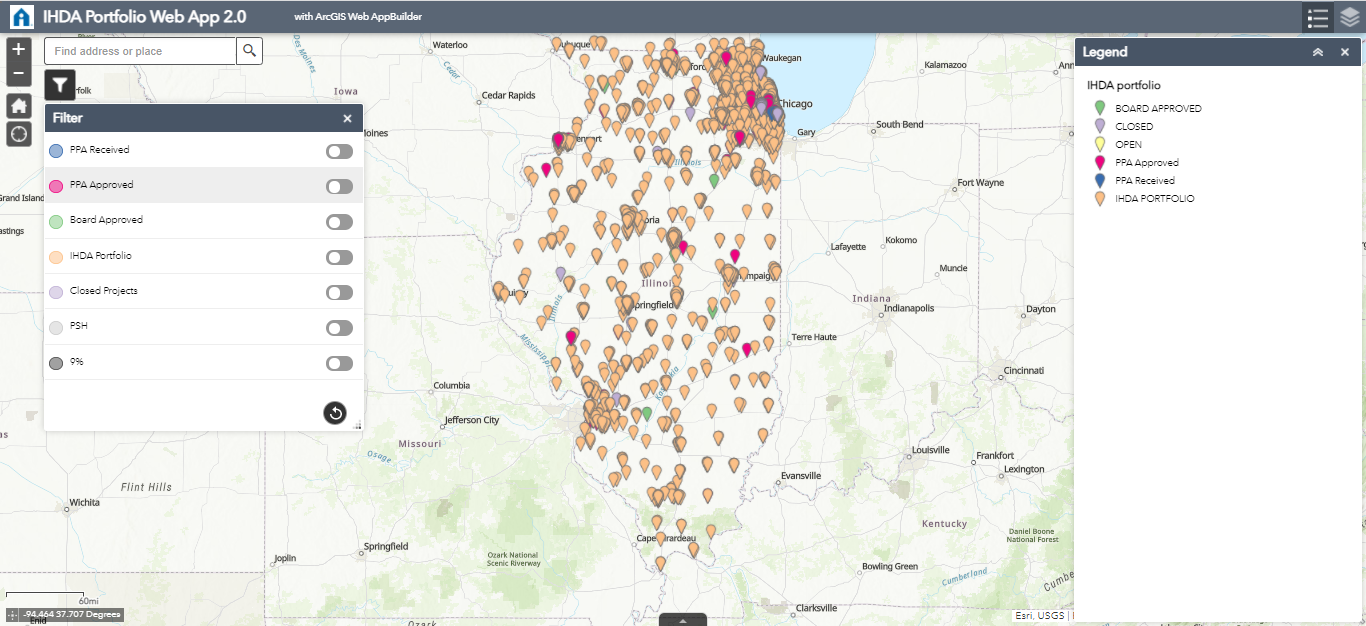

Low Income Housing Tax Credit Ihda

New Markets Tax Credit Investments In Our Nation S Communities

New Markets Tax Credit Investments In Our Nation S Communities

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Low Income Housing Tax Credit Ihda

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Price Growth Hit Its Peak But Dutch Housing Market Is Far From Cooling Down Raboresearch

Interactive Map Electric Vehicle Purchase Incentives Per Country In Europe 2021 Update Acea European Automobile Manufacturers Association